A web developer’s life is often a rewarding one. But having your superior breathing down your neck might be not that encouraging. This is especially if he is demanding you to do more in less time. It can at times drive you nearly to the edge.

Those who are not actually doing the work sometimes forget how complex this job is. Building a connected IoT solution using hardware can be quite hard. With the right software, however, tasks such as these can then be a lot easier.

Here are some solutions we’ve gathered together that do just that. If you need a development tool to revamp an eCommerce site, you are in the right place. The same goes for the case if you simply want to learn more about the process and available tools. Our findings are based on site ranking, reviews, and overall value.

Table of Contents

1. monday.com

One way to make your life easier, and do so quickly, is to invest in a quality team management tool. Although the meaning of quality can vary from user to user, it typically addresses overall performance, flexibility, and an absence of bothersome restrictions or limitations.

monday.com scores a perfect 10 on all three counts. Besides being beautiful, colorful, and intuitive to use, this team management tool provides a platform that a team simply cannot do without whether it’s a team of two or a distributed team of hundreds or thousands of developers and other project stakeholders.

monday.com provides a valuable service by making a project’s workflow perform smoothly and efficiently. Just as importantly, it promotes transparency, team collaboration, and empowerment of individual team members.

It also centralizes processes and it helps connect people to those processes, which is important if not essential in preventing tasks from falling through the cracks and causing problems that can range from bothersome to devastating. More than 35,000 teams, from startups to Fortune 500 companies make up monday.com’s user base.

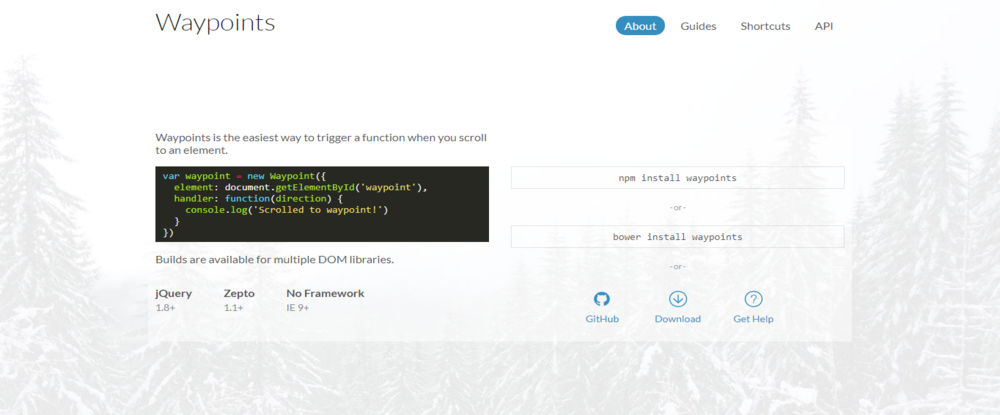

2. Waypoints

Waypoints is one of those must-have tools that you’d want to have in your toolbox if you are looking for the perfect way to facilitate scrolling animations and interactions. Considering the popularity of these elements in the modern website layouts and the fact that Waypoints is a free plan – you should definitely get your hands on it.

This flexible tool is the library that makes executing a function whenever you scroll to an element a breeze. It is available for jQuery, Zepto or in vanilla JavaScript. With Waypoints, you will be able to include the JavaScript file to the website, thanks to its module’s administration interface. Also, this useful plugin features an extensive base for UI patterns that vary depending on a user’s scroll position on the page.

Waypoints also has some extensions that enable the easier implementation of the common UI patterns. These include Infinite Scrolling, Sticky Elements and Inview Detection.

3. AND CO From Fiverr

Freelancers, agencies, and studios will like what this time tracking and invoicing app has to offer. AND CO already has a user base of more than 100 thousand businesses around the globe, it’s available on iOS, Android, and the Web, and you can use it to help run your entire business.

AND CO’s list of features is impressive. This app can do so many different things that you may begin to worry about how best to utilize all the extra free time you suddenly find yourself with.

Besides time tracking and invoicing, this remarkable app performs task management, manages payments, tracks expenses, helps you design customizable proposals, sets up recurring payment processes and much more.

Plus, it’s super simple to use; and best of all it’s absolutely FREE!

4. Nutcache

Nutcache is an all-in-one project management app. Its integration of financial capabilities with project management is certainly one of its outstanding features. These capabilities include helping you with initial project estimating and budgeting, time tracking, managing expenses, and automating the final billing process.

Nutcache is especially well suited for Agile developers and project managers. As such, this business-oriented web application fully supports Scrum, Kanban, and other Agile methodologies while helping teams manage a project throughout its lifecycle.

5. TMS Outsource

If you want to utilize the benefits of an outsourced development, TMS Outsource is exactly what you need. TMS is a small company of 30+ talented people. Together, they bring the best possible experience to 20,000 paying customers, having launched 5 own software products, and provide development services for companies worldwide.

At the moment, TMS Outsource uses Agile SCRUM methodology and features the following technologies and languages: PHP, MySQL, Javascript, Symfony, Slim, Vue.js, React, Redis, Elasticsearch.

How to Become a Better Developer?

Are you looking into improving yourself as a developer? Then, this is already a great step towards becoming one. There are many developers that think they are continuously advancing their programming skills. Yet, not many are doing so efficiently.

Here, we have gathered three key tips on how to become a better developer.

1. Read a lot of code

This guideline can serve as the most important rule when it comes to improving your skills. You may ask why?

Aside from just reading your code, you need to pay attention to what others write. This means that you will need to read a lot of others’ code in a bid to step up your own coding game.

However, do not just glance through the code — take your time to read it carefully and try to learn something from it.

2. Write it regularly

When you are working on some coding tasks, your skills are definitely developing. If you work on personal programming projects, this takes your coding to another level.

This approach provides you with a great opportunity to learn. You can explore many different tools and technologies, like the ones mentioned here. Besides, working on personal coding projects will add to your reputation and expertise.

3. Go the extra mile

Yes, you are right — it is always good to ensure that you fulfill the requirement of the project at first. However, many developers prefer to stop at this point and just move on to the next project.

However, this is not good enough if you are planning to perfect your coding skills. Here is what you need to do: once you are done with a particular project, think of how you can make it better.

Conclusion

It’s always a good feeling to come across a great service or an application. That’s exactly the feeling you’ll get by investing in any of the above products.

Each serves a two-fold purpose; to make your work easier, and to make the end result of a task or project better.