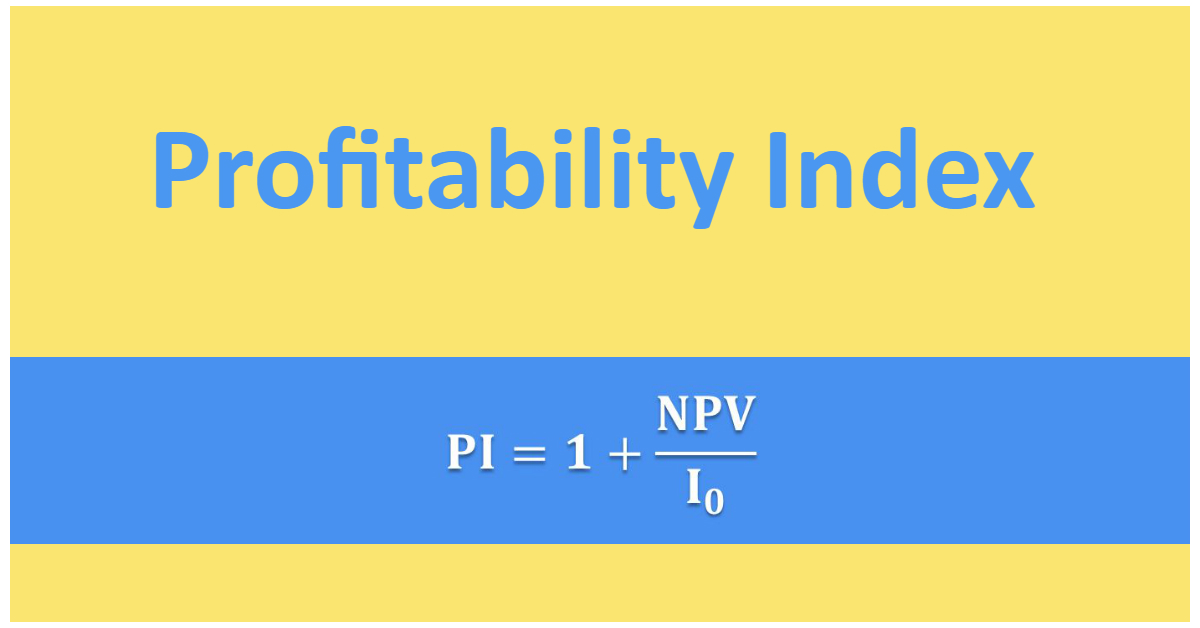

Profitability Index – PI is also called as Profit Investment Ratio (PIR) or even known as Value Investment Ratio that is VIR use of the method that is used to calculate the capital budget of a project is called the profitability index, you can also say that it is a modification calculation of net present value also known as NPV method. There is a difference in both, in NPV, it’s an absolute measure whereas in PI it is a relative measure of the project. In short, you can say that the profitability index is the calculated ratio that will show you how much profit you can get from a project, that is on per dollar you have invested.

The formula

Profitability index = present value of expected cash flow divided by the initial cost invested.

The rule is the decision

The decision depends on the ratio of one. Say if the project’s profitability index value you calculate is greater than 1 then it should be accepted, which will mean no profit no loss project it will be. If the value is greater then one then it should be definitely accepted as it will give you profit and if the value is lesser then 1 then that project will not give you any profit and you should not be accepting it.

Advantages and disadvantages of profitability index formula

The plus point you have while calculating the profitability index formula is that you get the same decision that you get by using the NPV method.

The problem comes in the project that is mutually exclusive and that also only if they differ in the size of investments, what will happen is that PI ranking and the NPV ranking will be different and the confusion will be built.

What is the Net Present Value formula?

It is the method which was initially used to calculate the profit of the investment.

What is the NPV Discount Rate?

The most important part while calculating NVP is the discount rate. Mostly the average cost of capital or the return rate on investment is used in NVP. It is simple that if NVP is lower the higher will be the discount rate, investments that have higher risk always have a higher discount rate then risks.

What is the formula for NVP?

Net Present Value (NPV) = Present Value (PV) – Investment (I)

In multiple investments it is calculated as cash flow divided by (1+r)t

For example

Single investment = rupees 1,50,000 – Rupees 10,000 – rupees 1,40,000

Multiple investments Rupees 1,50,000 / 1.1 = Rupees 1,36,363