Budgeting in QuickBooks is significant for your business development. Here in this article, we will examine how you can make spending plans and how can it work in QuickBooks appropriately. You can likewise get associated with QuickBooks Customer Service ProAdvisors to talk about this subject is profound.

Setting a yearly spending plan can assist you with planning your accounts so you generally have adequate assets to cover anticipated costs. QuickBooks business bookkeeping programming incorporates a planning highlight you can use to make a yearly spending plan and track your real consumptions against arranged uses consistently. The Quickbooks Support Number provides guidance to help you to create your budget.

Table of Contents

Making a Small Business Budget with QuickBooks Online

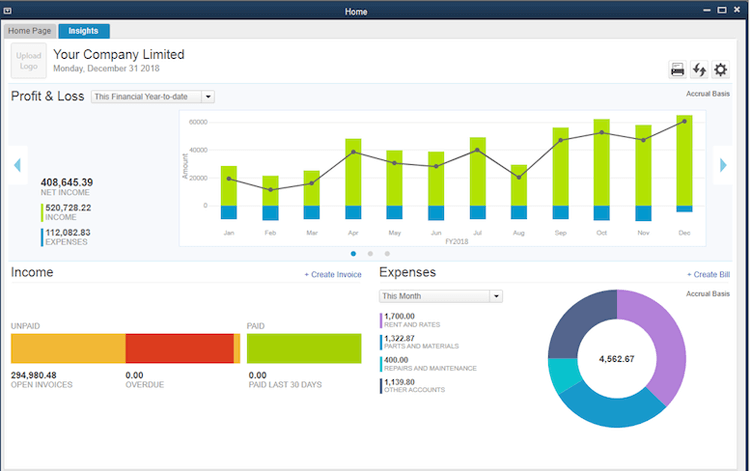

- With a QuickBooks Online spending plan set up, we’re ready to take a gander at every month and what we hope to see. At that point, we can contrast that and actuals in spending versus actuals report. This offers us the chance to the course right, making the important changes on the off chance that we have to a long time before it’s past the point of no return.

- QuickBooks Online has a spending highlight that gives you a chance to outline month to month sums for each record on your benefit and misfortune proclamation. The QuickBooks Online spending device has some decent highlights that make the way toward setting up your spending quick and simple.

- You can fill in your QuickBooks Online spending plan with real information from an earlier year. As a rule, this gets a significant part of the truly difficult work accomplished for you.

- Additionally, in the event that you have a ton of details that you need to spread equally throughout the months, at that point you can change the view to yearly and fill in the aggregate. At that point when you change back to a month to month, you’ll locate the yearly sum partitioned uniformly by 12 and populated into every month. This is another big deal saver.

Make a sub-Divided Budget plan:

- Select the Gear symbol at that point Budgeting.

- After that click Add Budget on the upper right corner.

- Enter the required data:

- Spending Name

- Spending limit Fiscal Year

- Interim: Monthly, Quarterly, or Annual

- Pre-Fill Data (select no/from the earlier year)

- Subdivide by, select:

- Try not to subdivide

- Area (might be requested Business, Department, Division, Territory, Store, and so on)

- Classes

- Client( Asked for Client, Donor, Member, Guest, Patient, Tenant, and so forth)

- Snap straightaway.

- At that point select the classification.

- After that enter the spending sums, at that point click spare at the lower right.

- Enter spending sums for all subdivided classes.

- Snap spare and close

Set up a Forecast

- Make educated expectations about your business’ future income and income. With QuickBooks Desktop Premier, Accountant, or Enterprise, you can make a budgetary estimate sans preparation, or from genuine information from the past financial year.

- Go to Company

- Select Planning and Budgeting

- And Set Up Forecast.

- Pick Create New Forecast.

- In the Create New Forecast window, indicate the monetary year for the new conjecture.

- You can indicate extra criteria of either Customer: Job or Class (if class following is on).

- Select whether you need to:

- Make gauge without any preparation: Manually enter sums for each record that you need to follow.

- Make gauge from the earlier year’s real information: Let QuickBooks Desktop naturally enter the month to month aggregates from a year ago for each record in the conjecture.

- Select Finish.

Create a Budget

- Go to Company

- Select Planning and Budgeting

- And Set Up Budgets.

- Choose New Budget

- Determine the spending year, at that point pick among Profit and Loss and Balance Sheet.

- (For-Profit and Loss Budget) Specify extra criteria of either Customer: Job or Class (if class following is on).

- ( and Loss Budget) Select whether you need to:

- Make spending plan sans preparation: Manually enter sums for each record that you need to follow.

- Make spending plan from the earlier year’s genuine information: Let QuickBooks Desktop consequently enter the month to month aggregates from a year ago for each record in the financial limit.

- Select Finish.